Skydo, India’s leading cross-border payments platform for exporters, has raised USD 10 million in a Series A round led by Susquehanna Asia Venture Capital (SAVC), with continued backing from existing investor Elevation Capital. The Bengaluru-based fintech, already trusted by more than 30,000 MSMEs, freelancers, and startups across 50+ Indian cities, plans to use this capital to accelerate its ambition of becoming the financial operating system for Indian exporters.

Skydo processes international payments in 32+ currencies and was among the first companies to receive the Reserve Bank of India’s In-Principle Authorisation as a Payment Aggregator – Cross Border (PA-CB)—a regulatory framework designed to bring transparency, security, and compliance discipline to India’s rapidly expanding export ecosystem.

A Booming Export Opportunity, Held Back by Broken Payment Infrastructure

India is aiming for USD 2 trillion in exports by FY30, propelled by millions of globally competitive MSMEs, digital service providers, freelancers, and technology startups. But while Indian exporters are world-class in capability, their payment infrastructure remains stuck in the past.

For decades, receiving money from overseas clients has been an opaque, slow, and expensive ordeal. Exporters commonly lose 3–7% of their earnings to hidden forex mark-ups and unclear bank fees. Payments often take multiple days to arrive, and once they do, exporters spend weeks or months gathering documentation such as FIRA and reconciling bank statements for compliance.

This friction not only erodes margins but also blocks working capital—one of the biggest pain points for small exporters trying to scale globally.

Skydo’s Solution: A Financial Operating System for Exporters

Skydo is looking to fundamentally rewire how India participates in global commerce. The platform allows exporters to collect payments locally in their clients’ countries, dramatically improving speed and reducing cost. A core part of Skydo’s differentiation is its zero-forex-fee model, flat, transparent pricing, and 24-hour settlement, which gives MSMEs full clarity and control over their revenue.

Beyond just payments, Skydo has built a full-stack operating system to support export workflows:

- Automated compliance: Instant generation of FIRA and regulatory documents

- Accounts receivable tooling: Invoicing, payment reminders, client dashboards

- Accounting integrations: Seamless reconciliation with ERP and bookkeeping systems

- Global collections: Local accounts across multiple geographies

By eliminating negotiation-heavy forex processes and allowing predictable cash forecasting, Skydo simplifies a notoriously complex step in the exporter journey.

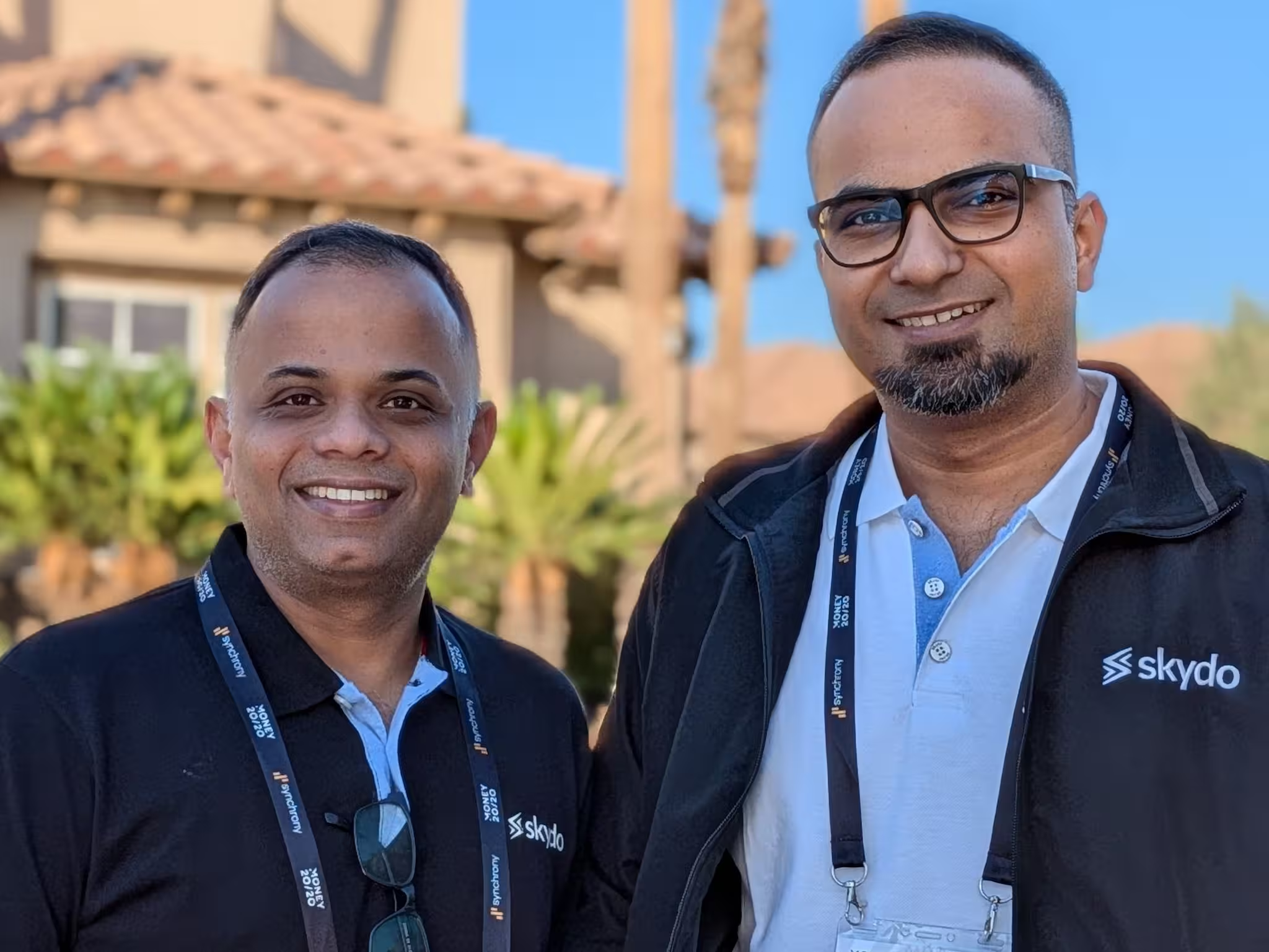

“Indian exporters are second to none in their global ambition. Skydo aims to enable them with world-class payment infrastructure built from India for the world,” said Srivatsan Sridhar, co-founder and CEO of Skydo. “This funding fuels our mission to build the financial operating system for global commerce—from collections, payouts, card acceptance, compliance automation, and accounting reconciliation.”

Fixing What Traditional Banks and Global Platforms Haven’t

For years, Indian exporters had limited options:

- Traditional banks with opaque fees, slow movement, and heavy paperwork

- Global platforms like PayPal, Wise, and Payoneer—useful but not built for Indian compliance and often charging up to 10% of invoice value in fees

Skydo positions itself as the India-first alternative that combines the compliance strength of a regulated financial institution with the transparency and user-friendliness of modern SaaS.

Customers echo the platform’s value:

- Sushant Yadav, founder of Optimite, shared:

“Skydo has simplified our cross-border payments and cut our finance costs dramatically. Their fixed fees and mid-market rates give us full predictability and better value than any bank we’ve worked with.” - Abhishek Agarwalla, Co-founder & CEO of Fabric, highlighted Skydo’s customer obsession:

“Skydo saved me from haggling with banks on FX rates every time I received a payment. But what truly stands out is how customer-obsessed they are. The entire team—even the founders—once visited our office just to understand our challenges firsthand.”

Skydo’s rapid adoption across MSMEs, SaaS startups, agencies, and freelancers indicates a significant demand for an India-centric global payments platform.

Scaling Ambition: 4X Growth and a USD 5 Billion Volume Target

Skydo has grown 4X in the past year and now aims to scale to USD 5 billion in annualized payment volume within the next two years. The company believes India has the capability to build global-grade financial infrastructure locally.

“We’re demonstrating that India has the talent, compliance muscle, and regulatory clarity to build global financial infrastructure from here, for the world,” said Movin Jain, co-founder of Skydo. “This round allows us to expand our footprint, enhance compliance systems, and secure licenses in key geographies.”

Investor Confidence in Skydo’s Model

Investors back Skydo not just for its growth but for its regulatory alignment and deep focus on solving exporter pain points.

- Bhavanipratap Rana, Investment Advisor, Susquehanna Asia VC, explained:

“The PA-CB framework demands high-quality players with strong technological capabilities. Skydo’s approach to tackling opacity, time delays, compliance risks, and working capital blockage sets it apart. We believe their model is perfectly suited to capture high-volume B2B business.” - Mridul Arora, Partner at Elevation Capital, highlighted the team’s execution:

“Since partnering with Skydo at inception, we’ve been impressed by the speed and precision with which they’ve scaled. They’ve built a customer-centric international payments powerhouse and grown 4X in just one year.”

Investor enthusiasm underscores the massive opportunity in reshaping India’s export payment infrastructure.

What the Series A Funding Will Unlock

The fresh USD 10 million infusion will accelerate Skydo’s roadmap across five major pillars:

1. Geographic Expansion

Skydo will launch local collection accounts across 20+ new countries, especially in Latin America, Africa, Southeast Asia, and the Middle East, enabling exporters to operate more globally with minimal friction.

2. Global Licensing

The company plans to secure regulatory licenses in key international markets, strengthening compliance frameworks and unlocking new corridors for higher-volume B2B payments.

3. Card Acceptance Infrastructure

Skydo will scale InstaLinks, its next-gen card acceptance product designed for exporters. It promises costs nearly 50% lower than traditional payment gateways, unlocking a powerful, easy-to-use channel for receiving payments.

4. Advanced Compliance & Reconciliation Suite

Exporters will gain access to deeper tools for reporting, reconciliation, and automated documentation, reducing back-office overhead and eliminating manual errors.

5. Developer Platform

Skydo will introduce APIs and webhooks that allow SaaS companies, marketplaces, and fintechs to embed Skydo’s global payment rails directly into their products—positioning Skydo as infrastructure, not just a standalone application.

A New Chapter in India’s Global Payments Story

India’s exporters have long battled unpredictability, inefficiency, and unnecessary cost in cross-border payments. Skydo is emerging as a transformative force—one marrying regulatory compliance, transparent pricing, and rapid settlement with modern software UX.

With its Series A funding, Skydo stands poised to shape the next chapter of India’s export economy. As MSMEs and startups push deeper into global markets, Skydo’s vision of a “financial OS for global commerce” may well redefine how Indian businesses get paid across borders.

Also Read – Top 10 Startup Scandals That Shocked Investors