New Fund Offers, commonly known as NFOs, attract attention whenever markets turn optimistic. Many investors view an NFO as an opportunity to enter a scheme at a low price and participate in future growth from day one. Despite this popularity, several fund houses deliberately stay away from launching NFOs. Their reluctance does not reflect a lack of innovation or confidence. Instead, it reflects a disciplined philosophy that prioritizes long-term value, investor outcomes, and operational efficiency. A closer look at their reasoning explains why avoiding NFOs often makes strategic sense.

Focus on Proven Track Records

Experienced fund houses prefer schemes with a performance history. A track record allows investors and advisors to evaluate how a strategy behaves across market cycles. NFOs offer no such evidence. When a fund house launches a brand-new scheme, investors rely solely on promises, projections, and marketing narratives.

Fund houses that avoid NFOs often choose to expand existing schemes instead. They add assets gradually and allow the investment philosophy to demonstrate consistency. This approach builds credibility through results rather than slogans. Investors gain clarity on risk, volatility, and return patterns, while fund houses avoid the pressure of proving a new concept from scratch.

Avoidance of Product Proliferation

The mutual fund industry already offers thousands of schemes across categories. Every new NFO adds another option to an already crowded shelf. Some fund houses believe that excessive choice confuses investors and dilutes accountability.

By avoiding NFOs, these fund houses limit product clutter. They concentrate on a compact lineup with clear objectives. Advisors find it easier to recommend such funds, and investors find it easier to understand them. This restraint also signals maturity and confidence in existing offerings rather than dependence on novelty.

Alignment With Investor-Centric Philosophy

Many NFOs emerge from market trends. Bull markets encourage thematic, sectoral, or strategy-based launches that capitalize on current sentiment. Fund houses that avoid NFOs often resist this temptation. They prioritize investor goals over short-term asset gathering.

This philosophy values suitability and discipline. Instead of launching a new fund whenever a theme gains popularity, these fund houses guide investors toward appropriate existing schemes. They reduce the risk of investors entering overheated sectors at the wrong time. Such restraint strengthens trust and reinforces a long-term partnership with investors.

Cost and Operational Efficiency

Launching an NFO requires significant resources. Marketing campaigns, distributor commissions, compliance work, and operational setup demand time and money. Fund houses that skip NFOs redirect these resources toward portfolio management, research, and investor service.

This efficiency improves overall fund quality. Research teams gain more time to analyze companies and macro trends. Operations teams focus on smoother transactions and better reporting. Over time, these improvements enhance investor experience more than frequent product launches ever could.

Liquidity and Deployment Challenges

An NFO often attracts large inflows within a short period. Fund managers then face the challenge of deploying this capital efficiently. In markets with limited opportunities, rapid deployment can hurt returns. The fund manager may need to buy stocks at unfavorable valuations just to stay invested.

Fund houses that avoid NFOs prefer gradual inflows. Existing schemes receive money over time, which allows thoughtful allocation. Fund managers take advantage of market corrections and valuation gaps. This flexibility supports better portfolio construction and risk management.

Marketing-Driven Perception Risks

NFOs rely heavily on marketing narratives. Advertisements often highlight potential themes, growth stories, or unique strategies. While such communication attracts attention, it can also create unrealistic expectations.

Fund houses that avoid NFOs distance themselves from hype-driven selling. They let performance, transparency, and communication drive investor interest. This approach reduces reputational risk. Investors associate the brand with stability and honesty rather than promotional noise.

Regulatory and Compliance Considerations

Every new scheme increases regulatory responsibility. Compliance teams must monitor disclosures, risk metrics, and reporting standards for each product. A large and growing scheme list complicates governance.

Some fund houses intentionally limit schemes to maintain strong oversight. They ensure that every fund receives adequate attention from compliance, risk, and audit teams. This discipline reduces the chance of errors and reinforces ethical standards. Avoiding NFOs helps maintain this control.

Preference for Portfolio Customization

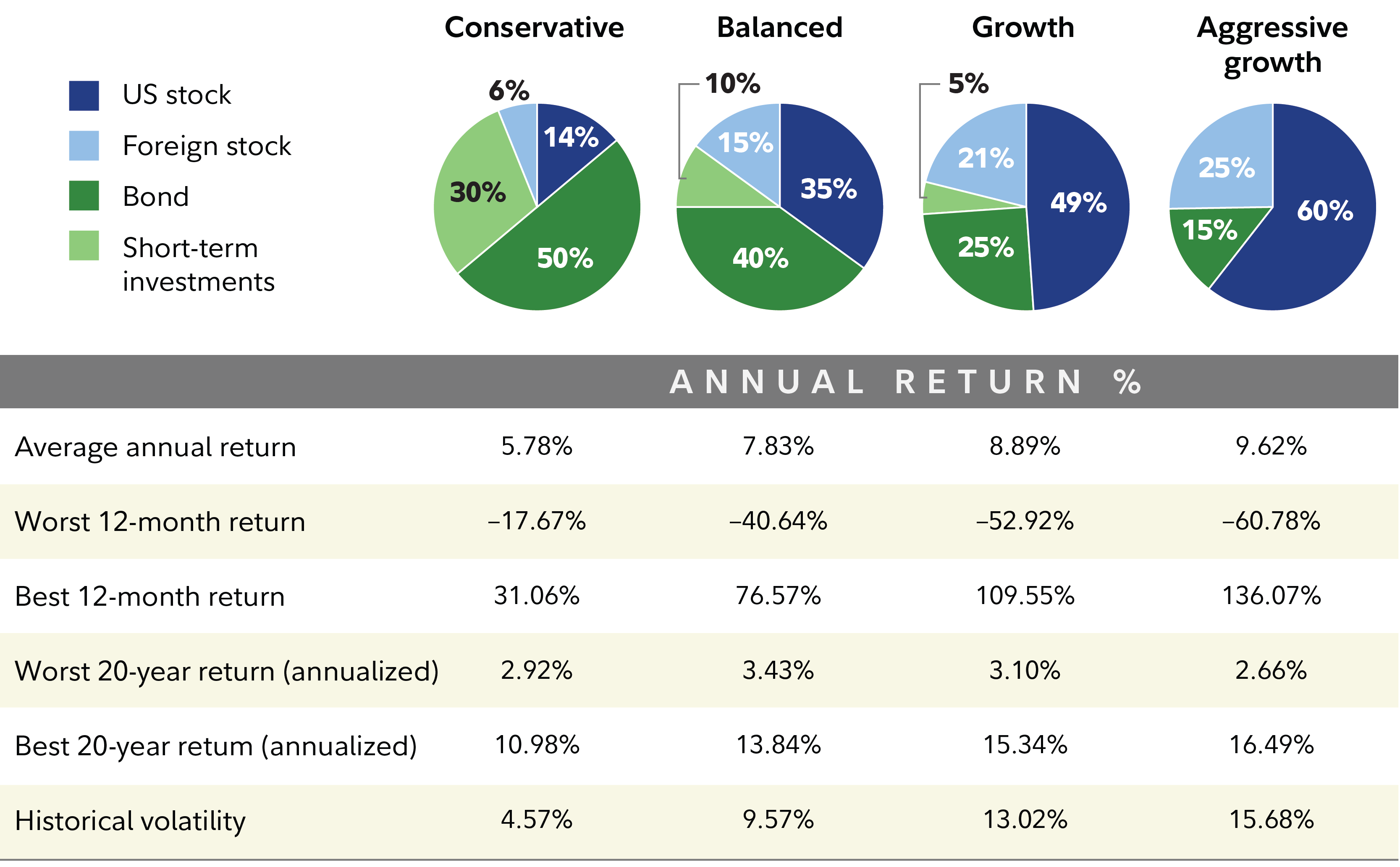

Several fund houses believe that portfolio construction should adapt to investor needs rather than product creation. Instead of launching new schemes, they encourage advisors to build customized asset allocation using existing funds.

This method emphasizes suitability. Investors combine equity, debt, and hybrid funds based on goals and risk appetite. Fund houses that support this approach see no urgency to launch NFOs for every emerging idea. They rely on asset allocation and rebalancing to deliver outcomes.

Learning From Past Cycles

History offers many examples where NFOs launched at market peaks struggled afterward. Sector funds launched during booms often delivered disappointing returns when cycles turned. Fund houses with long memories learn from these episodes.

By avoiding NFOs, they avoid repeating past mistakes. They recognize that timing risk affects new schemes more severely. Existing funds with diversified portfolios handle market shifts better. This historical awareness shapes a conservative and responsible product strategy.

Distributor and Advisor Relationships

Advisors play a critical role in fund distribution. Frequent NFOs can strain advisor relationships. Advisors must learn new products, explain them to clients, and manage expectations repeatedly.

Fund houses that avoid NFOs simplify the advisor’s role. They offer stable products with known behavior. Advisors appreciate this clarity and often develop deeper conviction in recommending such funds. Strong advisor trust supports sustainable asset growth without constant launches.

Long-Term Brand Building

Brand reputation grows slowly but suffers quickly. Fund houses that resist NFO-driven growth focus on brand equity rather than asset spikes. They communicate consistency, discipline, and patience.

Over time, investors associate these brands with reliability. This perception attracts informed investors who value process over excitement. Such investors tend to stay invested longer, which benefits both parties. Even advisory firms like Perfect Finserv often appreciate fund houses that demonstrate this long-term orientation.

Conclusion

Some fund houses avoid NFOs not because of hesitation, but because of conviction. They choose depth over breadth, discipline over hype, and outcomes over optics. By focusing on proven strategies, operational efficiency, investor suitability, and brand trust, they build sustainable businesses that serve investors well across cycles. In an industry where novelty often steals attention, restraint sometimes delivers the greatest value.

Also Read – Why Everyone Is Talking About Direct Mutual Funds