The year 2025 has emerged as another pivotal phase for the global technology and startup ecosystem, defined by continued workforce reductions across both early-stage startups and established technology giants. Although the intensity of layoffs has eased compared to the peak disruption witnessed during 2022–2023, job cuts remain a structural feature of the industry’s broader recalibration. Rather than representing short-term reactions to crisis, layoffs in 2025 increasingly reflect deliberate, long-term business realignments.

So far in 2025, the technology sector has recorded 716 layoff events, impacting a total of 209,838 employees worldwide. This translates to an average of approximately 591 job losses per day, underscoring that workforce reductions remain significant despite a moderation in pace. These figures highlight that while the industry is no longer experiencing the extreme volatility of previous years, downsizing continues to be a consistent and ongoing trend.

By comparison, 2024 saw a higher level of workforce disruption. During that year, 1,115 tech companies announced layoffs, affecting 239,101 employees, with an average of 655 layoffs per day. The year-over-year decline in both the number of layoff events and employees impacted suggests that the industry has begun to stabilize. However, the reduction is incremental rather than dramatic, indicating a slow and cautious transition rather than a full recovery.

Despite the lower total headcount reduction in 2025, layoffs have remained broad-based. Startups, mid-stage scaleups, and large publicly listed technology firms have all been affected. Early-stage startups continue to cut roles to extend financial runway amid tighter funding conditions, while late-stage companies are restructuring to improve margins and prepare for delayed exits or public listings. Meanwhile, large technology corporations are conducting strategic workforce reductions despite maintaining strong revenues, reflecting a shift toward operational efficiency rather than survival.

A defining feature of layoffs in 2025 is the change in intent behind them. Unlike earlier years, where emergency cost-cutting dominated decision-making, current workforce reductions are increasingly driven by strategic restructuring. Companies are redesigning organizational structures to align with evolving market realities, prioritizing leaner teams, clearer accountability, and improved productivity. The widespread adoption of artificial intelligence and automation has accelerated this transition, enabling firms to maintain or even increase output with fewer employees.

Additionally, there is a stronger emphasis on long-term profitability and capital discipline. Investors are demanding sustainable growth, predictable cash flows, and efficient use of capital. As a result, companies are reducing roles that do not directly contribute to core revenue generation or strategic differentiation.

This report explores the underlying drivers behind the 2025 layoff cycle, examines sector-specific and regional patterns, assesses the unique challenges faced by startups, and evaluates the impact on employees and the future of work. Together, these insights provide a comprehensive view of how the technology industry is reshaping its workforce in pursuit of resilience, efficiency, and sustainable growth.

1. The Global Context of Tech Layoffs in 2025

1.1 From Growth at Any Cost to Sustainable Operations

The global technology industry has fundamentally changed its hiring philosophy in 2025. Companies no longer chase growth at any cost. Instead, founders, executives, and investors now emphasize financial discipline and operational sustainability. This shift marks a clear departure from the expansion-heavy period fueled by near-zero interest rates and abundant venture capital between 2020 and 2022.

During the boom years, startups hired aggressively to capture market share, often prioritizing speed over efficiency. As funding conditions tightened, many organizations recognized structural inefficiencies in their workforce. In 2025, companies actively correct this imbalance by focusing on capital efficiency, sustainable revenue models, cash flow discipline, and measurable returns on headcount. These priorities now guide hiring, retention, and restructuring decisions across the tech ecosystem.

Startups that expanded teams rapidly during earlier growth cycles continue to recalibrate their organizational structures. Leadership teams review each function through a performance-driven lens, retaining roles that directly support revenue generation, product differentiation, or long-term strategic value. As a result, many layoffs in 2025 reflect planned workforce optimization rather than emergency cost reduction. Founders design leaner operating models to extend runway, improve margins, and align teams with realistic growth expectations.

Large technology companies follow a similar approach. Even firms with strong balance sheets and stable revenues restructure teams to improve productivity and reduce redundancy. By streamlining management layers and consolidating overlapping functions, these companies aim to operate with fewer resources while maintaining output. This industry-wide reset signals a permanent change in how tech companies evaluate workforce size and effectiveness.

1.2 Macroeconomic Influences

Macroeconomic conditions continue to exert significant influence over layoff decisions in 2025. Persistently high interest rates limit the flow of venture capital, forcing startups to operate under stricter financial constraints. Investors demand clearer paths to profitability, prompting founders to prioritize cost control and revenue sustainability over rapid expansion.

At the same time, slower global economic growth reduces enterprise technology spending. Many corporate customers delay software upgrades, renegotiate contracts, or reduce discretionary IT budgets. This environment directly impacts revenue forecasts for SaaS providers, enterprise service firms, and cloud platforms, leading leadership teams to adjust workforce levels accordingly.

Geopolitical uncertainty also plays a critical role. Ongoing trade tensions, regional conflicts, and supply chain disruptions increase operational risk for global technology companies. To manage uncertainty, executives favor conservative planning assumptions and flexible cost structures, including tighter control over headcount.

Persistent inflation further compounds these pressures by increasing salaries, infrastructure costs, and vendor expenses. Rather than absorb rising costs indefinitely, companies restructure teams and invest in automation to protect margins. Although global recession fears have eased compared to 2024, uncertainty remains high enough for boards and founders to prioritize resilience over aggressive hiring. In this environment, layoffs function as a strategic tool to ensure long-term stability rather than a temporary response to crisis.

2. Layoff Statistics: 2025 vs 2024

2.1 Key Numbers at a Glance

A direct comparison between 2024 and 2025 reveals a clear shift in the scale and nature of workforce reductions across the global technology sector. In 2024, tech companies announced 1,115 layoff events, impacting 239,101 employees, with an average of 655 job losses per day. These figures reflected a year dominated by aggressive cost-cutting, investor pressure, and widespread uncertainty across startups and large enterprises.

By contrast, 2025 year-to-date data shows 716 layoff events, affecting 209,838 employees, or approximately 591 layoffs per day. While the number of people impacted remains substantial, the decline in both total layoff events and daily averages indicates a measurable slowdown in workforce reductions. Companies have reduced the frequency of layoffs, even as the overall impact continues to affect hundreds of thousands of employees globally.

This numerical shift highlights a transition from crisis-driven decisions to more structured workforce planning. Rather than reacting to sudden market shocks, companies now integrate layoffs into broader strategic and financial roadmaps.

2.2 What the Numbers Reveal

The data clearly shows that fewer companies are laying off employees in 2025 compared to 2024. This trend suggests that many organizations have already completed the most urgent phases of workforce correction. Startups that once relied on repeated layoffs to manage cash burn have stabilized their team sizes, while larger firms have adjusted staffing levels closer to long-term operating needs.

However, despite fewer layoff events, the scale of individual layoffs remains large, particularly among enterprise technology companies. When major firms reduce headcount, they often do so in thousands rather than hundreds. These large-scale reductions significantly influence overall employment figures and explain why total layoffs remain high even as the number of affected companies declines.

Another critical insight from the data involves the nature of workforce reductions. In 2024, many companies executed abrupt and widespread layoffs under intense financial pressure. In 2025, leadership teams now plan layoffs in advance, phase them over multiple quarters, and align them with strategic priorities such as automation, product consolidation, or geographic restructuring. This approach allows organizations to manage costs while maintaining operational continuity and employee morale among retained teams.

The numbers also reinforce a broader conclusion: the tech industry has reached a phase of stabilization rather than recovery. Hiring has not returned to pre-2022 levels, and companies remain cautious about expanding headcount. At the same time, the era of mass panic layoffs appears to have ended. Organizations now operate with clearer visibility into demand, funding availability, and long-term growth potential.

In summary, the 2025 versus 2024 comparison reflects an industry that has moved past emergency response mode but has not yet entered a full hiring rebound. Tech companies continue to optimize workforce size with discipline, signaling a more mature and sustainable approach to growth moving forward.

3. Monthly Layoff Trends in 2025

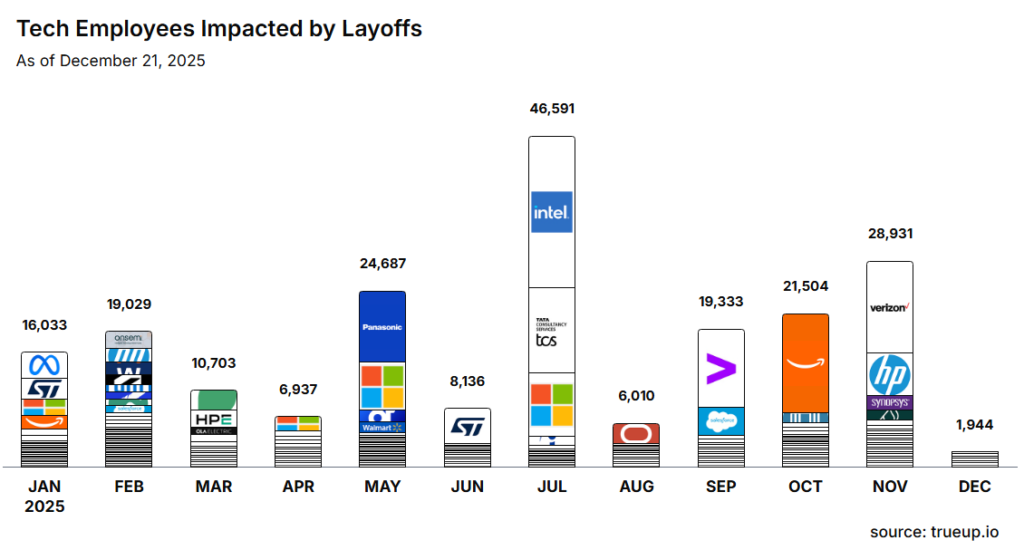

Layoff activity in 2025 has followed a wave-like pattern rather than the sharp, unpredictable spikes seen in earlier years. Companies now time workforce reductions to align with budgeting cycles, fundraising milestones, and strategic planning processes. This shift reflects a more disciplined approach to workforce management across the technology sector.

January and February set the tone for the year as companies initiate post-holiday restructuring. Leadership teams finalize annual budgets during this period and reassess staffing needs against revised revenue forecasts. Many organizations use the first quarter to eliminate redundant roles, close underperforming business lines, and reset cost structures. Startups and large enterprises alike treat early-year layoffs as part of annual planning rather than emergency interventions.

During March and April, venture-backed startups accelerate workforce adjustments. Founders review burn rates and runway ahead of mid-year fundraising efforts. Companies aiming to raise capital prioritize lean operations to strengthen investor confidence. As a result, startups reduce non-essential roles in marketing, operations, and expansion teams while preserving core product and engineering functions. These months often bring targeted layoffs designed to extend financial runway and improve unit economics.

Layoff activity intensifies between May and July, driven primarily by large enterprise technology firms. During this period, companies implement workforce reductions tied to automation initiatives and artificial intelligence adoption. Leadership teams restructure departments to reflect productivity gains from AI-driven tools and platforms. Many organizations consolidate roles, reduce management layers, and realign teams around fewer but higher-impact projects. These mid-year layoffs often involve larger headcount reductions but occur through structured, multi-phase plans rather than sudden announcements.

In August, layoff activity typically slows. Many companies pause major organizational changes during summer months, especially in regions where employee availability drops due to holidays. Executives use this period to evaluate the impact of earlier restructuring and assess performance metrics before making additional decisions. While some targeted layoffs continue, overall volumes decline temporarily.

The pace increases again from September through November as companies prepare for fiscal year-end. Leadership teams reassess annual performance, finalize budgets for the following year, and integrate acquisitions completed earlier in the cycle. Mergers and acquisitions frequently result in role overlap, prompting additional workforce reductions. Companies also adjust staffing to align with revised strategic priorities, particularly in sales, customer support, and regional operations.

In December, layoffs taper off significantly. Most organizations avoid major workforce disruptions during the holiday season to protect morale and maintain operational stability. Companies defer large restructuring efforts to the following year, choosing instead to focus on closing financial books and planning for the next cycle.

This recurring monthly pattern demonstrates a critical shift in how the tech industry approaches layoffs. Companies no longer treat workforce reductions as last-resort responses to sudden crises. Instead, they integrate layoffs into annual business planning, financial forecasting, and strategic execution. This evolution underscores a more mature and predictable approach to workforce management in 2025.

4. Startups vs Big Tech: Who Is Cutting More?

Layoffs in 2025 affect both startups and large technology companies, but the scale, frequency, and motivation behind these cuts differ significantly. Startups account for a higher number of layoff events, while Big Tech firms impact more employees per announcement. This contrast highlights two distinct approaches to workforce reduction within the tech ecosystem.

4.1 Startup Layoffs in 2025

Startups continue to represent a substantial share of layoff activity in 2025. Many early- and mid-stage companies operate under intense financial pressure as venture funding remains selective and capital costs stay elevated. Founders now prioritize survival, efficiency, and financial discipline over rapid expansion.

Several factors commonly trigger startup layoffs. Failed or delayed funding rounds force leadership teams to reduce burn rates immediately. Down-round valuations push founders to reset cost structures in order to protect long-term equity value. Unsustainable unit economics, particularly in customer acquisition-heavy business models, compel startups to reduce sales, marketing, and support teams. In many cases, startups also cut roles after pivoting business models, especially when previous product strategies no longer align with market demand.

Over-hiring during the 2020–2022 growth cycle continues to affect startups in 2025. Many companies expanded sales, growth, and operations teams ahead of revenue maturity. As growth slowed, these teams became misaligned with actual business needs. Founders now focus on smaller, highly productive teams that directly support product development, customer retention, and revenue generation.

Early-stage startups often execute aggressive layoffs to extend runway and preserve optionality. These companies aim to survive long enough to reach the next funding milestone or achieve profitability. Late-stage startups, by contrast, approach layoffs more strategically. Leadership teams restructure organizations to improve margins, streamline operations, and prepare for potential IPOs or acquisition discussions. In both cases, startup layoffs reflect financial necessity rather than choice.

4.2 Big Tech Layoffs

Large technology companies take a different approach. Big Tech firms announce layoffs less frequently, but when they act, they do so in large batches, often affecting thousands of employees at once. These reductions significantly influence overall layoff statistics despite fewer events.

Several strategic factors drive Big Tech layoffs in 2025. AI-led automation enables companies to deliver the same or higher output with fewer employees, especially in customer support, operations, and internal tooling functions. Product line consolidation eliminates overlapping teams and deprioritizes underperforming offerings. Reduced enterprise IT spending forces large vendors to realign sales and account management teams with slower demand growth.

Outsourcing and offshoring also play a major role. Many large firms shift routine work to lower-cost regions or external vendors, reducing headcount in high-cost markets. Additionally, mergers and acquisitions often create duplicated roles across engineering, finance, HR, and sales, prompting post-integration workforce reductions.

Unlike startups, Big Tech companies often announce layoffs during periods of strong revenue and profitability. These firms cut jobs to improve efficiency, boost margins, and reallocate resources toward strategic priorities such as AI, cloud infrastructure, and platform development. This dynamic reinforces a critical distinction: startup layoffs focus on survival, while Big Tech layoffs focus on optimization.

Together, these contrasting patterns explain why layoffs remain widespread across the tech industry in 2025, even as motivations and outcomes differ sharply between startups and large technology enterprises.

5. Sector-Wise Breakdown of Layoffs

Layoffs in 2025 vary significantly by sector, reflecting differences in demand cycles, cost structures, and technological disruption. While some segments face structural slowdowns, others undergo workforce changes driven by efficiency gains and strategic realignment.

5.1 Software and SaaS

The software and SaaS sector remains one of the most impacted areas of the tech industry in 2025. Slower enterprise subscription growth has forced companies to revise revenue expectations and adjust staffing levels accordingly. Longer sales cycles delay cash inflows, placing pressure on operating margins and making aggressive hiring unsustainable.

At the same time, rising customer acquisition costs reduce the return on large sales and marketing teams. Many SaaS companies now streamline go-to-market functions, especially roles tied to outbound sales and growth marketing. Leadership teams shift focus toward customer retention, expansion within existing accounts, and product-led growth strategies.

Despite these cuts, SaaS firms continue to protect and invest in core engineering, platform reliability, and AI capabilities. Companies view these roles as essential for product differentiation and long-term competitiveness. This selective approach results in leaner commercial teams paired with highly specialized technical talent.

5.2 Semiconductor and Hardware

Semiconductor and hardware companies have experienced notable layoffs in 2025 due to cyclical demand fluctuations. After periods of overproduction, many firms now face inventory corrections that require cost containment. Capital-intensive manufacturing processes amplify financial pressure during demand slowdowns, prompting leadership teams to reduce workforce expenses.

Although long-term demand for chips remains strong—driven by AI, electric vehicles, and cloud infrastructure—short-term volatility continues to influence employment decisions. Companies optimize staffing to align with production schedules, delay expansion plans, and improve capital efficiency during down cycles.

5.3 E-commerce and Consumer Tech

Consumer tech and e-commerce companies continue to right-size after years of hypergrowth. During earlier expansion phases, many firms built large logistics, fulfillment, and marketing teams to support rapid demand growth. As consumer spending normalizes, these cost structures no longer match revenue levels.

In response, companies optimize logistics networks, reduce marketing expenditures, and increase automation across warehouses and customer support functions. Layoffs in this segment primarily affect operations, supply chain management, and customer service, rather than core product development or engineering roles. Firms aim to maintain platform stability while lowering fulfillment and acquisition costs.

5.4 Fintech

Fintech companies face layoffs driven by regulatory pressure, slower credit growth, and rising competition. Compliance requirements increase operational complexity and cost, especially for startups operating across multiple jurisdictions. Slower consumer and small-business borrowing reduces transaction volumes and revenue growth.

In response, many fintech startups narrow their product offerings and exit non-core or unprofitable markets. Leadership teams consolidate teams around high-margin products and core financial services. These strategic cuts aim to improve sustainability and reduce regulatory exposure rather than scale aggressively.

5.5 AI and Cloud: A Paradoxical Trend

The AI and cloud sector presents a paradox in 2025. Investment in artificial intelligence continues to surge, yet layoffs persist. Companies replace traditional roles with AI-powered tools, reducing the need for large support and operational teams. At the same time, organizations restructure around smaller, high-impact groups capable of delivering greater output through automation.

Demand now concentrates on specialized AI talent, including machine learning engineers, data scientists, and infrastructure experts. Broad-based hiring declines, creating a talent polarization effect where highly skilled professionals see strong demand while generalist roles face ongoing pressure.

6. Regional Layoff Patterns

Regional differences play a significant role in shaping layoff trends across the global technology sector in 2025. Workforce reductions reflect variations in market maturity, labor costs, regulatory environments, and economic conditions.

6.1 United States

The United States remains the epicenter of tech layoffs in absolute terms due to its large and highly concentrated technology workforce. Companies continue to reduce headcount across major innovation hubs, with layoffs heavily concentrated in California, Texas, Washington, and New York. These states host a dense mix of startups, scaleups, and multinational technology firms, making them especially sensitive to shifts in funding, demand, and corporate strategy.

High labor costs in these regions accelerate workforce optimization efforts. Many companies now reduce roles in expensive urban hubs while expanding hiring in lower-cost domestic regions or international markets. Leadership teams restructure teams to balance cost efficiency with access to skilled talent, often adopting distributed or hybrid workforce models. This geographic rebalancing reshapes the U.S. tech employment landscape, shifting growth away from traditional centers.

6.2 India

India continues to experience fewer layoffs compared to Western markets and plays an increasingly important role in global workforce redistribution. Technology companies expand hiring in India across AI, cloud computing, cybersecurity, and enterprise services, driven by strong technical talent availability and cost advantages.

While India’s startup ecosystem faces selective layoffs due to funding slowdowns, these cuts remain targeted rather than widespread. Founders focus on extending runway and narrowing business scope instead of executing large-scale workforce reductions. At the same time, multinational technology companies transfer work previously performed in higher-cost regions to Indian teams. This shift allows firms to maintain productivity while controlling expenses.

As a result, India increasingly absorbs roles displaced by global layoffs, particularly in engineering, IT services, and back-office operations. This trend strengthens India’s position as a strategic hub in the global tech workforce.

6.3 Europe

European technology companies face layoffs driven by slower economic growth, elevated energy costs, and regulatory complexity. These factors pressure margins and reduce growth expectations, especially for startups and mid-sized firms operating across multiple countries.

However, strong labor protections significantly shape how companies execute layoffs in Europe. Employers often engage in negotiations with worker councils and unions, extending timelines and reducing the speed of workforce reductions. Companies rely more on hiring freezes, voluntary exits, and contract non-renewals rather than abrupt terminations. As a result, European layoffs tend to occur gradually and with greater procedural oversight.

6.4 Emerging Markets

Emerging markets such as Latin America, Southeast Asia, and Africa experience selective layoffs in 2025, primarily within consumer-focused startups. Many of these companies expanded rapidly during periods of easy capital, building teams ahead of sustainable revenue growth. As funding conditions tightened, founders adjusted headcount to align with realistic market demand.

Despite these cuts, emerging markets continue to attract technology investment, particularly in fintech, digital payments, and enterprise software. Layoffs in these regions reflect correction rather than collapse, signaling a transition toward more disciplined growth models across developing tech ecosystems.

7. Why Layoffs Continue Despite AI Growth

One of the most striking contradictions of 2025 lies in the simultaneous surge in artificial intelligence investment and the continued reduction of tech workforces. Companies across the technology sector pour capital into AI tools, platforms, and infrastructure while continuing to cut jobs. This dynamic does not reflect a collapse in demand for talent but rather a fundamental transformation in how organizations structure work.

AI significantly increases output per employee, allowing smaller teams to deliver results that previously required much larger workforces. Engineering, product development, customer support, data analysis, and marketing functions now rely heavily on automation, intelligent workflows, and AI-driven decision systems. As productivity rises, leadership teams reassess headcount requirements and reduce roles that no longer contribute proportional value.

As organizations adopt AI at scale, redundant roles quickly disappear. Repetitive, process-heavy tasks—such as manual reporting, basic customer support, quality assurance, and routine operations—no longer justify large teams. Companies streamline these functions, retaining only roles that oversee systems, manage exceptions, or drive strategic outcomes. This shift leads to targeted layoffs focused on function rather than performance.

AI adoption also shifts organizational focus toward fewer, highly skilled contributors. Companies increasingly favor engineers, data scientists, and product leaders who can design, deploy, and optimize AI systems. At the same time, demand declines for generalist roles that lack direct impact on core business outcomes. This creates a workforce model built around expertise, adaptability, and cross-functional capability rather than sheer headcount.

Another critical factor involves the reduction of middle management layers. AI-powered analytics and collaboration tools provide executives with direct visibility into performance, project progress, and operational metrics. As decision-making becomes faster and more data-driven, companies reduce layers of management that once existed to coordinate information flow. Leadership teams flatten organizational hierarchies to accelerate execution and reduce overhead.

Importantly, AI does not directly cause layoffs in 2025. Instead, it accelerates organizational flattening and magnifies existing efficiency goals. Companies already under pressure to improve margins, control costs, and deliver predictable growth now use AI as a catalyst to redesign workflows and team structures. Layoffs occur as a consequence of these redesigns, not as a direct response to AI replacing humans outright.

This dynamic reshapes the labor market. Professionals with AI-adjacent skills experience strong demand, while workers in routine or narrowly defined roles face increasing risk. Companies reward adaptability, technical fluency, and problem-solving ability, signaling a long-term shift in employment patterns.

In summary, layoffs continue in 2025 not because AI reduces the need for human talent, but because it redefines the value of each role. Organizations that embrace AI require fewer people, but they demand higher impact from those they retain.

8. Impact on Employees

The ongoing wave of tech layoffs in 2025 has reshaped how employees approach careers, compensation, and professional stability. Workforce reductions no longer represent isolated events; instead, they influence long-term behavior, skill development, and employment expectations across the technology sector.

8.1 Skill Relevance Over Job Titles

In 2025, skills matter more than job titles. Employees who possess expertise in artificial intelligence and machine learning, cloud infrastructure, cybersecurity, data engineering, and product management secure new roles faster than those in generalized or narrowly defined positions. Employers now hire for impact, adaptability, and technical depth rather than traditional role classifications.

Companies seek professionals who can operate across functions, manage complex systems, and contribute directly to revenue or product innovation. Engineers who understand AI deployment, product managers who leverage data-driven decision-making, and security experts who protect increasingly automated systems remain in high demand. In contrast, employees whose roles center on routine tasks or manual processes face longer job searches and fewer opportunities.

This shift encourages workers to invest in continuous learning and skill upgrades. Professionals who proactively build AI fluency, cloud expertise, and cross-functional capabilities improve their employability and resilience in an evolving labor market.

8.2 Compensation Reset

Layoffs in 2025 also drive a reset in compensation structures across the tech industry. During the hiring boom of earlier years, companies offered inflated base salaries, aggressive equity packages, and signing bonuses to attract talent. As market conditions changed, these compensation levels became unsustainable.

In response, employers now offer lower base salaries, smaller equity grants, and greater emphasis on performance-linked pay. Companies tie compensation more closely to measurable outcomes such as revenue growth, product delivery, and customer retention. This approach aligns employee incentives with business performance while reducing fixed cost burdens.

Although this reset challenges workers accustomed to peak-era compensation, it creates clearer expectations and more sustainable pay models. High performers continue to earn competitive rewards, while organizations gain greater flexibility to manage costs during economic uncertainty.

8.3 Mental Health and Career Uncertainty

Repeated layoff cycles have taken a measurable toll on employee mental health. Uncertainty around job security increases stress levels, contributes to burnout, and weakens emotional attachment to employers. Many professionals now approach roles with caution, recognizing that even high-performing teams face restructuring.

As a result, employee loyalty has declined. Workers prioritize personal resilience and career portability over long-term commitments to a single company. Many professionals now favor employers with stable revenue models, predictable leadership, and conservative growth strategies.

This shift has also changed career risk tolerance. Fewer employees willingly join early-stage startups unless compensation, mission, or learning opportunities justify the uncertainty. Instead, many prioritize job security, financial stability, and clear career progression.

Overall, the impact of layoffs in 2025 extends beyond employment numbers. Workforce reductions reshape employee behavior, redefine value in the labor market, and reinforce the importance of adaptability, mental well-being, and strategic career planning.

9. How Founders Are Responding

9.1 Lean Team Philosophy

Startups are embracing:

- Smaller teams

- Cross-functional roles

- AI-assisted workflows

9.2 Longer Runways

Founders are targeting:

- 24–36 months of runway

- Conservative hiring

- Revenue-first strategies

9.3 Delayed IPOs and Exits

Many late-stage startups are postponing public listings, opting instead for internal restructuring.

10. Layoffs and the Future of Work

10.1 Hybrid and Remote Models

Layoffs have accelerated the shift toward:

- Distributed teams

- Contract-based hiring

- Global talent sourcing

10.2 Rise of Fractional Roles

Companies are replacing full-time roles with:

- Fractional CTOs

- Contract engineers

- Project-based teams

This trend is expected to grow through 2026.

11. Outlook for the Rest of 2025

11.1 Will Layoffs Continue?

Yes, but at a slower, more controlled pace.

- Mass layoffs are unlikely unless macro conditions worsen

- Ongoing restructuring will persist

- Hiring will remain selective

11.2 Key Indicators to Watch

- Interest rate cuts

- Venture funding recovery

- Enterprise IT spending

- AI productivity benchmarks

12. Conclusion

The startup layoff cycle of 2025 marks a clear turning point for the global technology ecosystem. Companies now operate under realistic economic constraints and prioritize sustainability over unchecked expansion. While layoffs continue to affect thousands of employees, they reflect a more mature and disciplined industry rather than a sector in crisis. Leaders no longer rely on rapid hiring to fuel growth. Instead, they design lean organizations that emphasize efficiency, accountability, and long-term value creation.

Compared to 2024, the tech industry shows greater stability but has not entered a full recovery phase. Fewer companies announce layoffs, yet workforce reductions remain significant in scale. Organizations now plan these cuts deliberately, align them with annual budgets, and connect them to strategic goals such as automation, AI adoption, and margin improvement. This shift demonstrates that layoffs have evolved into strategic management tools, not emergency responses to sudden shocks.

Technology-driven efficiency plays a central role in this transition. Artificial intelligence enables smaller teams to achieve higher output, pushing companies to rethink team structures and eliminate redundancy. Firms that succeed in this environment focus on high-impact talent, clear priorities, and measurable outcomes. Those that fail to adapt risk falling behind, regardless of their size or past success.

For professionals, the message is equally clear. Job security no longer comes from employer brand or rapid growth stories. Instead, it depends on relevant skills, adaptability, and continuous learning, especially in AI, cloud, data, and product leadership. Employees who evolve with technology position themselves for long-term resilience.

Ultimately, the 2025 layoff cycle signals an industry recalibrating for the next decade. Companies that balance innovation with financial discipline—and individuals who adapt to an AI-first world—will define the future of the technology sector.

Final Takeaway

2025 is not the end of tech layoffs—but it may be the beginning of a healthier, more disciplined tech industry.

Also Read – WealthTech 3.0: What Startups Can Build for AMCs